January 25, 2026 7:28 am

Subject: Environment

Section: Climate Change

Topic: China’s Carbon Market and Emissions Trading Mechanisms

China, the world’s largest emitter of greenhouse gases (GHG), is ramping up its efforts to curb emissions by expanding its Emissions Trading Scheme (ETS). The expansion includes high-emission industries such as cement, steel, and aluminum and aims to boost market liquidity. This is a significant step in China’s broader goal of sustainable development and carbon neutrality by 2060.

Why in News

China is currently seeking public feedback on its plan to integrate key industries into its carbon market, which is expected to be operational by the end of the year. This expansion is crucial for increasing the market’s effectiveness and ensuring that emission reductions align with national and global climate goals.

China’s Carbon Market Structure

China’s carbon market is divided into two main systems:

- Mandatory Emission Trading System (ETS)

- Voluntary Greenhouse Gas Emissions Reduction Market (China Certified Emission Reduction – CCER)

These systems, while operating independently, are linked through mechanisms that allow firms to use voluntary market credits (CCERs) to meet compliance targets under the ETS.

Emission Trading System (ETS)

The ETS is China’s mandatory carbon market that launched in July 2021 on the Shanghai Environment and Energy Exchange.

Initial Coverage

- The ETS initially covered over 2,000 major emitters in the power generation sector.

- To qualify, emitters had to produce at least 26,000 metric tons of emissions per year.

Expansion Plans

- The ETS will eventually cover eight sectors: power generation, steel, building materials, non-ferrous metals, petrochemicals, chemicals, paper, and civil aviation.

- These sectors collectively contribute to 75% of China’s total emissions.

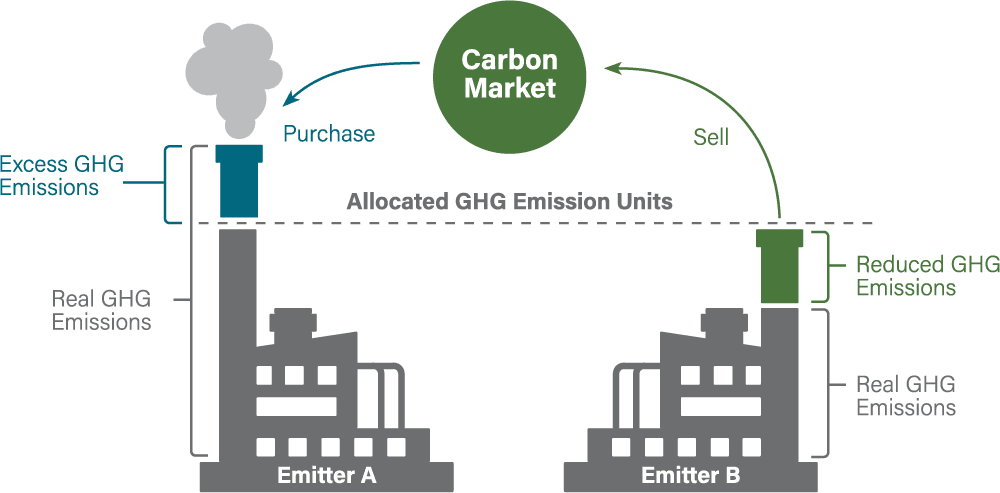

Mechanism of ETS

- Firms receive Certified Emission Allowances (CEAs) for free, based on industry-specific carbon intensity benchmarks set by the government. These benchmarks decrease over time, making emissions reductions progressively more stringent.

- If a company’s emissions exceed its quota, it must purchase additional CEAs from the market. Companies emitting below their quotas can sell excess allowances.

Carbon Pricing

- Carbon prices in China’s ETS are relatively lower than international markets. Prices rise as the government reduces quota allocations, increasing the demand for emission credits.

The China Certified Emission Reduction (CCER) Market

The CCER market is China’s voluntary GHG emission reduction market, relaunched in January 2023 after a suspension in 2017. The CCER market:

- Allows broader participation in carbon trading.

- Helps major emitters meet ETS compliance by enabling them to offset up to 5% of their total emissions with voluntary credits.

- The integration of new sectors into the ETS is expected to boost demand for CCERs, increasing trading volumes and market liquidity.

Global Carbon Markets Overview

Carbon markets facilitate the buying and selling of carbon emissions allowances to achieve global emission reductions.

Origin and Development

- The first carbon markets were established under the Kyoto Protocol (1996), becoming operational in 2000.

- The protocol mandated binding emissions reductions for developed countries and introduced three carbon market mechanisms:

- Emissions Trading: Developed countries could trade excess reductions with those falling short of targets.

- Joint Implementation (JI): Credits from emission-reducing projects could be traded between corporates in developed countries.

- Clean Development Mechanism (CDM): Enabled developed countries to invest in emission-reducing projects in developing nations, generating credits for trade.

Carbon Markets Under the Paris Agreement

The Paris Agreement introduces new carbon market frameworks under Article 6:

- Article 6.2: Facilitates bilateral arrangements for transferring emissions reductions between countries.

- Article 6.4: Establishes a global carbon market open to all entities, allowing for the trading of emission reductions.

- Article 6.8: Promotes non-market approaches for countries to meet emission reduction targets, encouraging cooperative climate action beyond traditional markets.

Prelims Questions

- Consider the following statements regarding China’s Emissions Trading Scheme (ETS):

- The ETS initially covered only the petrochemical and aviation sectors.

- Firms exceeding their emission quotas must buy additional Certified Emission Allowances (CEAs).

- (a) 1 only

- (b) 2 only

- (c) Both 1 and 2

- (d) Neither 1 nor 2

Explanation: The ETS initially covered the power generation sector, not petrochemical and aviation sectors. Statement 2 is correct. - Which of the following mechanisms were introduced under the Kyoto Protocol for carbon trading?

- Joint Implementation (JI)

- Clean Development Mechanism (CDM)

- Carbon Market under Article 6 of the Paris Agreement

- (a) 1 and 2 only

- (b) 2 and 3 only

- (c) 1 and 3 only

- (d) 1, 2, and 3

Explanation: The Kyoto Protocol introduced JI and CDM. Article 6 of the Paris Agreement pertains to a different carbon market mechanism.

Mains Question

Analyze the significance of China’s Emissions Trading System (ETS) in global efforts to combat climate change. Discuss the challenges China faces in implementing an effective carbon market and suggest potential solutions.

Answer Framework:

- Introduction: Briefly explain the importance of carbon markets in reducing global emissions and highlight China’s role as the largest emitter of GHGs.

- Body:

- Significance of China’s ETS: Explain how the ETS contributes to global emission reduction efforts, enhances market-based solutions, and aligns with international climate commitments.

- Challenges: Discuss issues such as low carbon pricing, inadequate enforcement mechanisms, and the complexity of integrating new sectors.

- Solutions: Propose measures like increasing carbon price benchmarks, enhancing monitoring systems, and fostering international cooperation to align carbon markets.

- Conclusion: Emphasize the potential of a robust ETS to drive meaningful change in China’s emissions and its ripple effects on global climate action.

Explanation:

- Significance: China’s ETS could set a precedent for emerging economies to adopt market-based emission reduction strategies.

- Challenges: Addressing the current gaps in implementation and ensuring consistent policy enforcement are critical.

- Solutions: Recommendations include policy reforms, collaboration with global markets, and public-private partnerships.