January 25, 2026 1:51 am

STATE OF THE ECONOMY: GETTING BACK INTO THE FAST LANE

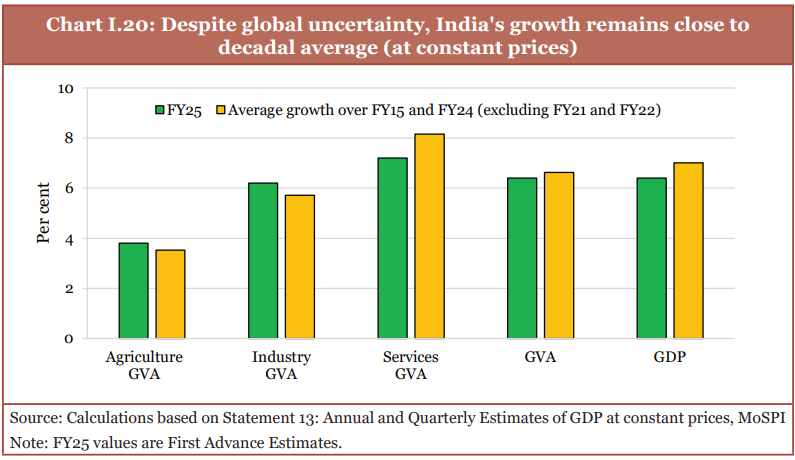

The Economic Survey Chapter 1 explains that global economy in 2024 is like a car stuck in traffic—some regions are moving ahead smoothly, while others face roadblocks. India, however, is navigating through the challenges efficiently, maintaining a steady pace of growth.

What’s happening?

- The world economy is growing, but not evenly. Some regions like the U.S. are stable, while Europe and China are struggling.

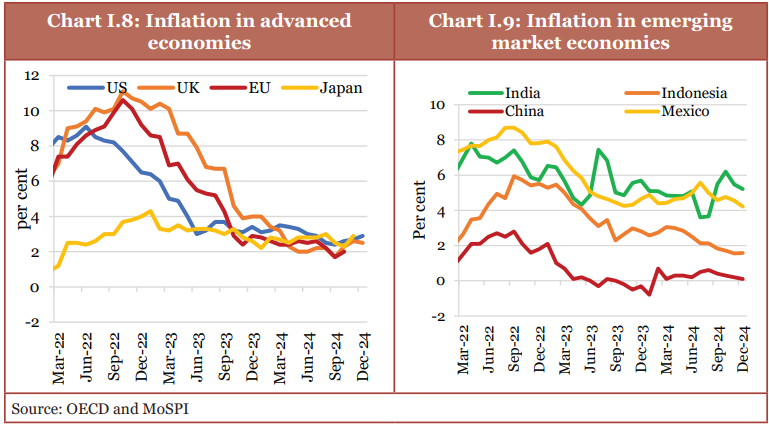

- Inflation has cooled, but services remain expensive, making it tricky for central banks to decide on interest rates.

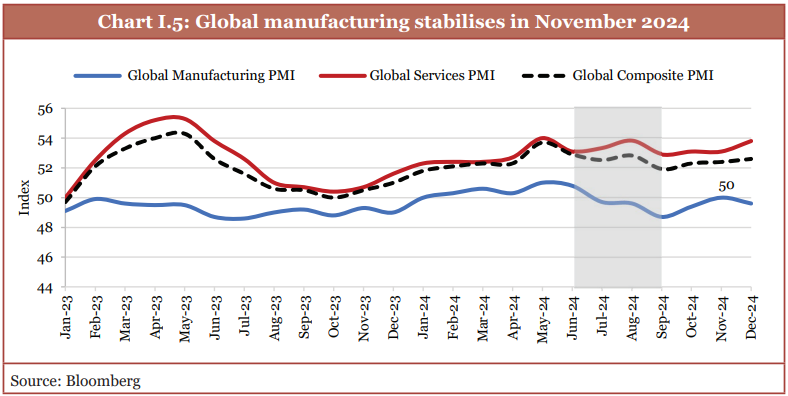

- Global manufacturing is slowing down, but services are doing well—especially in countries like India.

- Geopolitical risks, trade restrictions, and supply chain disruptions are adding uncertainty to global markets.

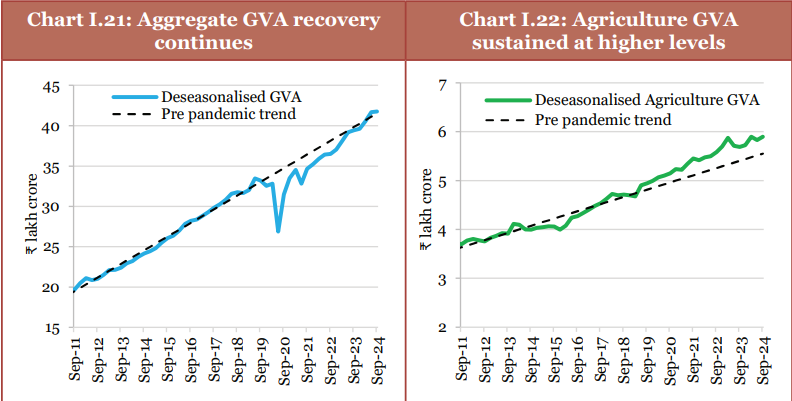

In this backdrop, India is expected to grow at 6.4% in FY25, despite pressures in manufacturing and external demand. The real strength of India’s economy is coming from:

✅ Agriculture, which has rebounded due to a strong Kharif harvest.

✅ Services, which continue to be the biggest contributor to growth.

✅ Private consumption, which remains strong despite global slowdowns.

✅ Government spending on infrastructure, which is keeping investments high.

But there are challenges too:

❌ Manufacturing is slowing down due to weak exports and seasonal effects.

❌ Inflation in food prices remains a problem, even though overall inflation is stable.

❌ Geopolitical and trade tensions can disrupt economic momentum.

The next sections dive deep into what’s driving India’s growth, what problems need to be solved, and what the future holds.

1. THE GLOBAL ECONOMY: A SLOW AND UNEVEN RECOVERY

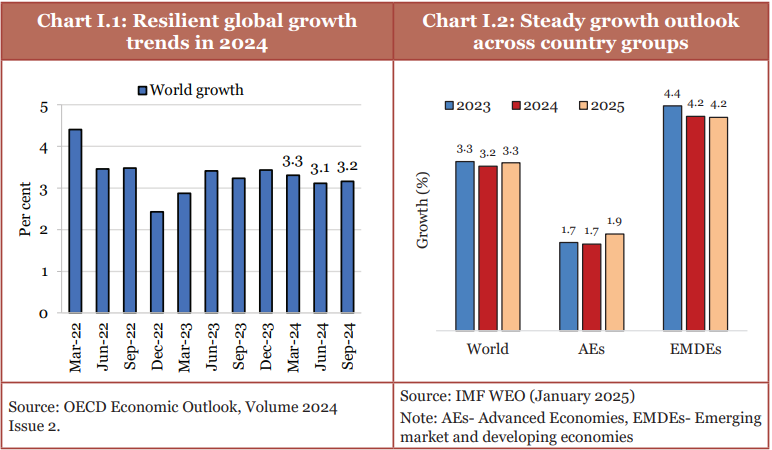

The world economy in 2024 is growing at 3.2%, as per the IMF projections, but that number hides big differences across regions.

United States: Strong But Slowing Down

- The U.S. economy is doing better than expected, with growth at 2.8% in 2024.

- Inflation has come down, but interest rates are still high, making borrowing expensive.

- Consumer demand is still strong, but signs of a slowdown are visible for 2025.

Europe: Struggling With Manufacturing Slowdown

- The Eurozone is barely growing (0.8%), with Germany and Austria facing a manufacturing slump.

- France, Spain, and Poland are doing better, but overall, the region remains weak.

- Policy uncertainty in major economies like Germany is making investors nervous.

China: Growth Losing Steam

- After a brief recovery, China’s economy weakened in Q2 2024, mainly due to:

- Low private consumption

- Real estate crisis

- Weak global demand for Chinese exports

- Growth is expected to slow further in 2025, making China less of a global growth driver than before.

Key Takeaways for India

✅ India benefits from U.S. and European demand for services (IT, finance, business services).

❌ But weak global demand affects India’s manufacturing exports, particularly steel, electronics, and chemicals.

❌ Trade policy changes, especially from the U.S. and Europe, could impact India’s exporters.

2. INDIA’S ECONOMIC PERFORMANCE: A MIXED PICTURE

India is growing at 6.4% in FY25, despite external uncertainties. Let’s break it down sector by sector.

A. AGRICULTURE: STRONG REBOUND BOOSTING RURAL DEMAND

- Growth rate: 3.8% in FY25 (higher than last year).

- Kharif food grain production: 1,647 lakh metric tonnes, 8.2% above the five-year average.

- Better monsoon and strong Rabi sowing mean agriculture will continue to support economic stability.

Why does this matter?

✅ Strong farm output = more income in rural areas = better demand for goods (bikes, FMCG, tractors, consumer products).

✅ Food inflation might reduce if supplies improve, which will help control overall inflation.

Challenges?

❌ Dependence on monsoon still remains a risk. If rainfall is unpredictable, the next crop cycle could be affected.

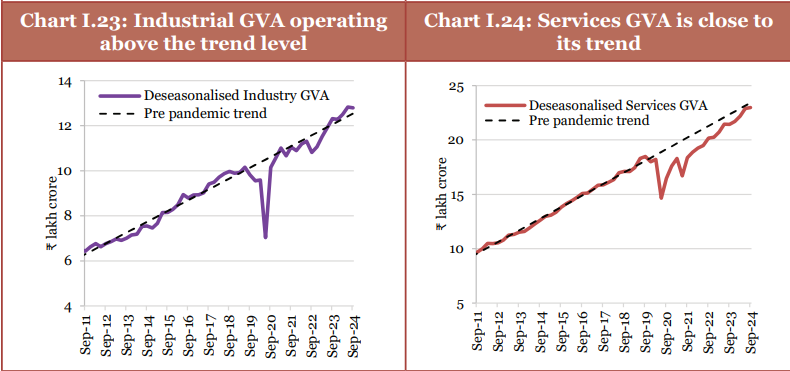

B. INDUSTRY & MANUFACTURING: GROWTH SLOWS DOWN

- Industrial growth: 6.2% in FY25 (lower than expected).

- Manufacturing is struggling due to weak exports, higher input costs, and sluggish global demand.

- Some key industries facing trouble:

- Steel: Prices have dropped due to oversupply in global markets.

- Cement: Demand slowed due to heavy rains and fewer construction projects.

- Oil & Refining: Companies faced inventory losses due to price volatility.

Why does this matter?

❌ Manufacturing needs to grow faster for job creation—it employs millions of people.

❌ Lower exports mean more pressure on domestic demand to drive economic growth.

Positives?

✅ Business expectations are improving, with stronger demand expected in Q3 and Q4.

✅ Government capex is helping the construction sector, which supports steel and cement demand.

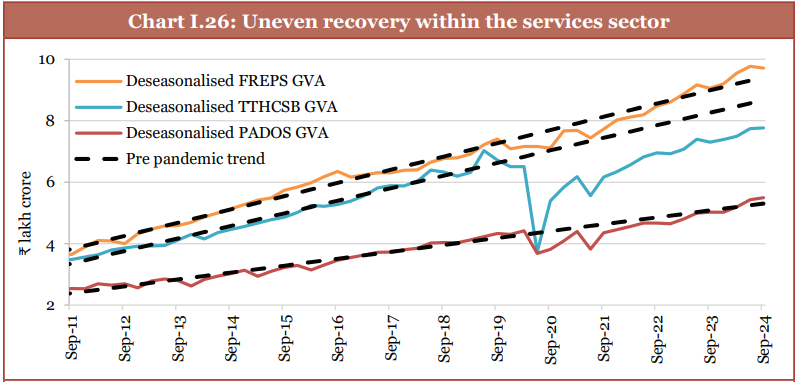

C. SERVICES: INDIA’S BIGGEST GROWTH DRIVER

- Growth: 7.2% in FY25, making it the strongest sector.

- Major contributors:

- Financial services (banking, insurance, stock markets)

- Real estate and professional services

- IT and tech sector exports

Why does this matter?

✅ Services contribute the most to India’s GDP (over 50%).

✅ Strong global demand for Indian IT & business services helps sustain job creation and forex earnings.

Challenges?

❌ Higher costs of skilled labor could impact IT and business services competitiveness.

3. INVESTMENT & INFLATION: WHAT’S HAPPENING?

A. Public & Private Investment: Balancing Growth

Investment plays a crucial role in sustaining economic momentum by driving infrastructure development, enhancing industrial capacity, and generating employment. In FY25, India’s investment trends have shown a mixed picture, with strong government spending but cautious private sector participation.

🔹 Government Capital Expenditure (Capex):

- Government capex grew by 8.2% in FY25, with heavy investments in infrastructure projects like roads, railways, power, and defense.

- The government’s focus on large-scale infrastructure development aims to improve connectivity, reduce logistical costs, and enhance trade efficiency.

- Increased spending on highways, metro projects, and renewable energy has created employment opportunities and supported construction activity.

- Public sector investment acts as a catalyst for private sector confidence, encouraging industries to expand operations.

🔹 Private Investment Trends:

- Private sector investment remains slow due to global uncertainty, high interest rates, and weak export demand.

- However, there are early signs of recovery—order books of capital goods companies expanded by 23.6% in FY24, indicating upcoming private investment growth.

- Capacity utilization in manufacturing has increased to 74.7%, suggesting that companies may soon ramp up production and capital spending.

- The Make in India initiative, PLI (Production-Linked Incentive) schemes, and corporate tax reductions continue to provide incentives for private investments.

- A revival in consumer demand and stability in input costs could further encourage businesses to increase investments in machinery, factories, and expansion projects.

B. Inflation: Stable, But Food Prices Remain a Problem

While overall inflation has remained within the Reserve Bank of India’s comfort range, food inflation continues to pose challenges. A rise in vegetable and pulse prices has affected household budgets, particularly in rural areas, where food expenses make up a larger share of overall spending.

🔹 Consumer Price Index (CPI) Trends:

- Overall inflation (CPI) averaged 4.9% between April-December 2024, staying close to the RBI’s target of 4%.

- Core inflation (which excludes food & fuel) has declined to 4.5%, indicating stable prices in non-food sectors.

- Food inflation surged to 8.4%, largely driven by high prices of vegetables and pulses due to weather-related supply disruptions and seasonal effects.

🔹 Why This Matters:

✅ Lower core inflation is good for businesses and households, as it provides price stability in services, housing, and transportation.

❌ High food inflation impacts household consumption, reducing disposable income and affecting demand for other goods.

❌ Volatile food prices create uncertainty, making it harder for policymakers to predict inflation trends and set interest rates.

✅ Better agricultural output and government price controls may help ease food inflation in the coming months.

4. INDIA’S EXTERNAL SECTOR: STRONG BUT RISKS REMAIN

India’s external sector has remained resilient despite global trade uncertainties, supply chain disruptions, and currency fluctuations. The trade balance, foreign exchange reserves, and remittances have provided stability, but challenges in global trade and investment flows remain a concern.

🔹 Exports & Trade Balance:

- India’s merchandise exports grew by 1.6% between April-December 2024, supported by stronger demand in key markets.

- Services exports (IT, business services, and financial services) continue to perform well, making India one of the top 7 global services exporters.

- Imports grew by 5.2%, led by demand for oil, gold, and electronic goods, which widened the trade deficit.

- The weakening of global demand for goods like textiles, chemicals, and auto components has weighed on export growth.

🔹 Foreign Exchange Reserves & Stability:

- India’s forex reserves stand at $634.6 billion (as of January 2025), providing a 10-month import cover.

- This ensures stability in the rupee, protects against external shocks, and provides confidence to global investors.

- A healthy foreign exchange reserve also helps the RBI manage currency fluctuations effectively.

🔹 Remittances: A Major Source of Foreign Inflows

- India continues to be the world’s largest recipient of remittances, with strong inflows from Indian workers in the Middle East, U.S., and Europe.

- High global employment rates, particularly in developed economies, have supported India’s remittance growth.

- Remittances contribute significantly to domestic consumption and financial stability, particularly in rural areas.

🔹 Concerns & Risks:

❌ Trade policy changes in Western countries could impact India’s exports, particularly in textiles, chemicals, and pharmaceuticals.

❌ Higher global interest rates might slow down foreign direct investment (FDI) inflows, as investors look for safer assets.

❌ Geopolitical risks (Middle East tensions, U.S.-China trade war, and Russia-Ukraine war) may disrupt global trade flows, indirectly affecting India’s exports and imports.

5. THE ROAD AHEAD FOR INDIA

India’s economic trajectory looks promising, but several key factors will determine whether the country can maintain its growth momentum in FY26 and beyond. Policymakers, businesses, and investors must focus on key growth drivers while addressing potential risks.

🔹 Opportunities: The Growth Catalysts

✅ Structural Reforms: Strengthening ease of doing business, reducing regulatory bottlenecks, and boosting labor market reforms can enhance India’s global competitiveness.

✅ Manufacturing Expansion: The PLI (Production-Linked Incentive) schemes across sectors like electronics, pharmaceuticals, and semiconductors are expected to increase industrial output and exports.

✅ Investment in Future Industries: India must accelerate investments in high-tech industries like semiconductors, AI, and green energy, positioning itself as a global leader in emerging technologies.

✅ Infrastructure Growth: Continued focus on highways, metro projects, renewable energy, and smart cities will provide a long-term boost to growth and employment.

🔹 Risks: Challenges That Need Attention

❌ Geopolitical tensions and trade disruptions: Conflicts in Ukraine, the Middle East, and U.S.-China tensions can disrupt global supply chains and investment flows.

❌ Climate & Weather Uncertainty: Erratic monsoons, rising temperatures, and extreme weather events could impact agriculture and food security, leading to price volatility.

❌ Private Investment Hesitation: If business sentiment does not improve, private sector investments might remain subdued, impacting long-term growth.

❌ Rising Global Interest Rates: Higher borrowing costs in developed countries might divert capital flows away from emerging markets, including India.

🔹 India’s Economic Growth Trajectory

- India is expected to grow at 6.3-6.8% in FY26, making it one of the fastest-growing major economies.

- Sustaining this growth will require strong policy support, including more private sector participation, investment in high-tech industries, and effective inflation management.

- If India successfully navigates global uncertainties, strengthens manufacturing, and improves investment flow, it can continue leading the global growth story.

🚀 The future is promising, but India needs to stay on the right track with strong policies and strategic investments! 🚀

6. LABOR MARKET & EMPLOYMENT: GROWTH, FORMALIZATION, AND CHALLENGES

India’s economic expansion is directly linked to job creation, and employment trends in FY25 show a mixed picture. The formalization of jobs has increased, thanks to rising enrollments in social security schemes, but unemployment in certain sectors remains a challenge. The government’s focus on skill development, infrastructure growth, and labor reforms will play a crucial role in shaping India’s workforce in the coming years.

A. Employment Trends: Signs of Improvement

- India’s unemployment rate has steadily declined, with the overall unemployment rate for individuals aged 15+ falling from 6% in 2017-18 to 3.2% in 2023-24.

- The urban unemployment rate improved to 6.4% in Q2 FY25, compared to 6.6% in Q2 FY24.

- Labor Force Participation Rate (LFPR) and Worker-Population Ratio (WPR) have increased, indicating greater participation of the workforce in economic activities.

- Government initiatives like PM Mudra Yojana and Startup India have played a role in boosting self-employment and entrepreneurship.

B. Formalization of Jobs & Social Security Growth

- Net EPFO (Employees’ Provident Fund Organization) enrollments doubled from 61 lakh in FY19 to 131 lakh in FY24, showing that more workers are joining the formal job market.

- In April-November 2024, net additions to EPFO reached 95.6 lakh, with youth (aged 18-25) making up nearly 47% of these additions.

- This shift indicates a move towards better job security, social benefits, and retirement planning.

C. Challenges in the Labor Market

❌ Employment generation in the manufacturing sector remains slow, impacting job opportunities for low and semi-skilled workers.

❌ Wage growth in some industries has been sluggish, reducing consumer purchasing power.

❌ The impact of AI and automation on traditional jobs is creating concerns about future workforce disruptions.

❌ Job opportunities in rural areas are still heavily dependent on agriculture, making them vulnerable to weather fluctuations and crop failures.

D. What Needs to Be Done?

✅ Upskilling and Reskilling Initiatives: Expanding programs like Skill India to ensure that India’s workforce is ready for high-tech industries, AI, and digital economy jobs.

✅ Boosting MSME Sector Employment: Small and medium enterprises (SMEs) employ millions of workers—supportive policies, credit availability, and easier compliance regulations can help MSMEs scale up and hire more workers.

✅ Strengthening Rural Employment Programs: Schemes like MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) must continue providing a safety net while encouraging private sector job creation in rural areas.

7. FINANCIAL SECTOR STABILITY: BANKING & CREDIT GROWTH

The Indian banking and financial system remains stable, with strong credit growth, declining bad loans (NPAs), and robust profitability. However, certain risks remain, particularly in consumer credit, unsecured loans, and global financial conditions affecting India’s capital flows.

A. Banking Sector Performance & Credit Growth

- Non-food credit growth remains in double digits, with strong demand from retail, services, and small businesses.

- Credit to MSMEs and personal loans has grown significantly, reflecting rising consumption and small business activity.

- Industrial credit growth is picking up, but remains below credit growth in other sectors.

- The gross non-performing assets (NPA) ratio has declined to 2.6%, the lowest in 12 years, indicating improved financial health of banks.

B. Consumer Credit Growth & RBI’s Intervention

- Rapid growth in personal loans and credit card spending has raised concerns over rising household debt.

- The RBI has increased risk weights on unsecured loans, making banks more cautious in lending to high-risk borrowers.

- Housing loans continue to drive retail credit, reflecting sustained demand in the real estate sector.

C. Foreign Portfolio Investment (FPI) & Capital Flows

- FPI flows into India have been volatile, with inflows slowing to $10.6 billion in April-December 2024, compared to $31.7 billion in the same period last year.

- India’s inclusion in global bond indices has attracted foreign investments in debt markets.

- Stable domestic growth and lower inflation have kept investor confidence high.

D. Stock Market Performance & Investor Sentiment

- Indian stock markets have performed well, with record highs in the Sensex and Nifty driven by strong corporate earnings and foreign investments.

- The Indian IPO market remains active, with several new listings raising capital.

- However, global financial market fluctuations and interest rate changes in the U.S. can impact India’s stock market movements.

🔹 What Needs to Be Done?

✅ Ensure responsible consumer credit growth to prevent household debt crises.

✅ Encourage SME lending to support small business expansion.

✅ Maintain banking sector resilience by keeping NPAs in check.

8. TECHNOLOGY & INNOVATION: BUILDING THE FUTURE ECONOMY

India is positioning itself as a global leader in technology, AI, and advanced manufacturing. The government’s focus on digital infrastructure, AI adoption, and semiconductor production will be key drivers of future economic growth.

A. AI & Digital Economy Growth

- India’s AI market is projected to reach $17 billion by 2027, with major investments from global tech companies.

- The adoption of AI across industries like healthcare, finance, and logistics is expected to boost productivity and efficiency.

- India’s IT and software services sector continues to thrive, with increasing global demand for cloud computing, cybersecurity, and AI-driven solutions.

B. Semiconductor & Electronics Manufacturing

- The government has announced a $10 billion incentive plan for semiconductor manufacturing, attracting investments from global chipmakers.

- India aims to become a major hub for semiconductor production, reducing dependence on imports and supporting high-tech industries.

- Expansion of electronics manufacturing (smartphones, laptops, automotive chips) is driving FDI and domestic production.

🔹 What Needs to Be Done?

✅ Accelerate AI and digital transformation initiatives to create future-ready jobs.

✅ Encourage domestic semiconductor production to strengthen India’s electronics industry.

✅ Enhance R&D investment to foster homegrown innovation and global competitiveness.

9. CLIMATE & ENERGY: INDIA’S GREEN TRANSITION

India is committed to sustainable growth and reducing carbon emissions, with strong investments in renewable energy, electric mobility, and climate resilience programs.

A. Renewable Energy Expansion

- India is targeting 500 GW of non-fossil fuel energy capacity by 2030, making it one of the fastest-growing renewable energy markets.

- Solar and wind energy investments have surged, with government incentives driving expansion.

- Hydrogen energy and battery storage technologies are emerging as key areas of focus.

B. Electric Vehicles (EVs) & Green Mobility

- EV adoption is rising rapidly, with government support through Faster Adoption and Manufacturing of Electric Vehicles (FAME) schemes.

- Tesla and other global EV players are considering India as a manufacturing hub, boosting local production.

- Charging infrastructure and battery development are improving, making EVs more viable.

🔹 What Needs to Be Done?

✅ Expand green finance initiatives to support climate-friendly projects.

✅ Strengthen electric vehicle infrastructure to encourage widespread adoption.

✅ Develop long-term energy security strategies to reduce dependence on fossil fuels.

10. FINAL OUTLOOK: INDIA’S PATH FORWARD

India’s economic outlook remains strong, with projected growth of 6.3-6.8% in FY26. Despite global uncertainties, India is well-positioned to maintain its growth momentum.

Key Priorities for the Future:

✅ Boost private sector investment to complement public spending.

✅ Expand manufacturing and export capacity to reduce trade imbalances.

✅ Ensure inflation remains under control, particularly in food prices.

✅ Strengthen India’s role in global tech & AI leadership.

✅ Continue infrastructure and green energy investments.

🚀 India is at a critical juncture—if the right policies and reforms are implemented, it can cement its position as a global economic powerhouse in the coming decade! 🚀

11. INDIA’S ROLE IN THE GLOBAL ECONOMY: BUILDING STRATEGIC PARTNERSHIPS

As one of the fastest-growing major economies, India is increasingly shaping the global economic landscape. With geopolitical shifts, trade realignments, and digital transformation, India has an opportunity to emerge as a leader in manufacturing, services, and strategic technology partnerships.

A. Strengthening Global Trade & Investment Ties

- Free Trade Agreements (FTAs): India has been actively negotiating and signing FTAs with key economies to expand export markets and attract foreign investments.

- India-UAE CEPA (Comprehensive Economic Partnership Agreement) boosted bilateral trade to $85 billion in 2024.

- India-UK FTA (under negotiation) aims to increase exports of technology, pharmaceuticals, and textiles.

- Talks with the EU and Canada are ongoing, with a focus on removing trade barriers and boosting investments.

- Diversification of Export Markets: With China’s economic slowdown, India is focusing on markets in Southeast Asia, Latin America, and Africa to reduce reliance on traditional export destinations.

- Supply Chain Realignment & “China Plus One” Strategy:

- Many global manufacturers are shifting operations from China to India, making India a key player in global supply chains.

- India’s PLI (Production-Linked Incentive) schemes are encouraging foreign investments in electronics, semiconductors, and renewable energy sectors.

B. Becoming a Global Technology & Innovation Hub

India’s rise as a tech powerhouse is driven by strong IT exports, digital infrastructure, and increasing R&D investments.

- India’s IT & software services sector contributes over 8% to GDP, with exports crossing $230 billion in FY25.

- Digital India and 5G expansion are enhancing connectivity, boosting fintech, e-commerce, and AI-driven services.

- AI & Quantum Computing Initiatives: India is partnering with global tech giants to develop AI solutions, quantum computing, and cybersecurity.

- Semiconductor Manufacturing:

- India’s $10 billion semiconductor initiative is attracting investments from global chipmakers.

- Tata Group and Vedanta have entered semiconductor manufacturing, reducing India’s dependence on imports.

C. Geopolitical Considerations & Global Alliances

India’s strategic positioning in global politics and trade alliances is evolving.

- Active participation in QUAD (India, US, Japan, Australia) and IPEF (Indo-Pacific Economic Framework) strengthens India’s presence in the Asia-Pacific.

- Closer defense and trade cooperation with the US and Europe could result in increased technology transfer and investments.

- India’s leadership in Global South discussions helps position the country as a voice for emerging economies.

12. INDIA’S URBANIZATION & INFRASTRUCTURE GROWTH

India is undergoing rapid urbanization, with cities expanding at an unprecedented rate. The government’s infrastructure push is aimed at improving connectivity, easing congestion, and enhancing quality of life.

A. Mega Infrastructure Projects & Connectivity

- PM Gati Shakti (National Infrastructure Plan) aims to integrate rail, road, ports, and digital networks.

- $1.5 trillion infrastructure investment planned under the National Infrastructure Pipeline (NIP).

- Railways modernization (dedicated freight corridors, high-speed rail projects, metro expansions) is enhancing transportation efficiency.

- Smart Cities Mission is improving urban planning, public transport, and sustainability in 100+ cities.

B. Real Estate & Housing Growth

- India’s real estate sector is rebounding, with housing demand rising across major metros.

- Affordable housing schemes like PMAY (Pradhan Mantri Awas Yojana) are increasing home ownership.

- Commercial real estate (offices, co-working spaces, data centers) is witnessing strong growth, fueled by IT and e-commerce expansion.

C. Urban Mobility & Public Transport Upgrades

- Metro rail projects are expanding rapidly in Delhi, Mumbai, Bengaluru, Chennai, and Hyderabad.

- Electric buses and shared mobility services are growing, reducing carbon footprints in urban areas.

- Highways & expressways (Mumbai-Delhi expressway, Bengaluru-Chennai expressway) are improving intercity connectivity.

13. AGRICULTURE TRANSFORMATION & RURAL DEVELOPMENT

Despite contributing 16-18% of GDP, agriculture still employs nearly 43% of India’s workforce. Modernization, technology integration, and policy support are key to boosting productivity and farmers’ incomes.

A. Agricultural Productivity & Sustainability Initiatives

- PM-KISAN scheme has provided direct income support to over 10 crore farmers.

- Digital agriculture platforms (eNAM, AgriStack) are improving market access and pricing for farmers.

- Use of drones and AI in farming is increasing precision agriculture and efficiency.

- Organic farming & sustainable practices are gaining momentum, with India emerging as a top organic produce exporter.

B. Rural Infrastructure Development

- Rural electrification has reached 99% of villages, improving economic opportunities.

- Internet penetration in rural India is driving digital payments and e-commerce growth.

- MGNREGA (employment scheme) continues to support rural workers, providing financial security.

14. EDUCATION, HEALTHCARE & HUMAN CAPITAL DEVELOPMENT

Investing in human capital—through education, skill development, and healthcare—is essential for sustaining long-term economic growth.

A. Education & Skilling Initiatives

- National Education Policy (NEP) 2020 is reforming school and higher education, emphasizing digital learning, vocational training, and skill-based courses.

- India’s edtech sector is booming, with platforms like BYJU’S, Unacademy, and upGrad driving online learning.

- Engineering, AI, and biotech education are being prioritized to develop a future-ready workforce.

B. Healthcare & Pharma Leadership

- India’s pharmaceutical industry remains a global leader, supplying 50% of global vaccines and 40% of generic medicines to the US.

- Ayushman Bharat scheme is expanding healthcare access to millions, strengthening public healthcare.

- Telemedicine and AI-driven diagnostics are improving rural healthcare access.

15. FINAL OUTLOOK: INDIA’S PATH TO A $5 TRILLION ECONOMY

A. Key Strengths Driving India’s Growth

✅ Stable GDP growth forecast of 6.3-6.8% in FY26, making India a top performer among major economies.

✅ Strong macroeconomic fundamentals: Low fiscal deficit, stable inflation, record forex reserves.

✅ Rising global influence: India’s leadership in climate change, trade, and digital transformation is strengthening.

✅ Technology leadership in AI, semiconductors, and renewable energy is shaping the future economy.

✅ Young workforce & digital economy growth are major competitive advantages.

B. Key Challenges That Need Attention

❌ Geopolitical risks (trade restrictions, war-related disruptions) could affect exports.

❌ Private sector investment still needs improvement to match public infrastructure spending.

❌ Unemployment in traditional industries remains a concern, requiring stronger labor market policies.

❌ Climate risks & food inflation need strategic interventions to ensure long-term stability.

C. What Will Drive India’s Future Growth?

- Massive infrastructure expansion (railways, highways, smart cities).

- Strengthening digital economy, AI adoption & semiconductor manufacturing.

- Green energy investments & EV adoption for sustainability.

- Stronger global trade partnerships & export diversification.

- Boosting private investment and financial inclusion for long-term resilience.

UPSC Mains Practice Questions (Economy & Governance)

1. Economic Growth & Investment

- India’s public capital expenditure has grown significantly, but private investment remains sluggish. Analyze the reasons behind this trend and suggest measures to boost private sector investment. (250 words)

- Discuss the role of infrastructure development in driving India’s economic growth. How can projects like PM Gati Shakti and the National Infrastructure Pipeline contribute to long-term economic stability? (250 words)

- India aims to become a global manufacturing hub under the ‘China Plus One’ strategy. Critically examine the effectiveness of PLI (Production-Linked Incentive) schemes in attracting foreign and domestic investment. (250 words)

2. Inflation & Monetary Policy

- Despite a decline in overall inflation, food prices continue to remain volatile in India. Discuss the structural factors responsible for high food inflation and suggest policy measures to address them. (250 words)

- How does core inflation impact economic stability? Analyze the recent trends in core inflation in India and discuss its implications for monetary policy decisions. (250 words)

3. External Sector & Global Trade

- India’s trade policy is undergoing a shift with Free Trade Agreements (FTAs) being negotiated with key economies. Discuss the potential benefits and risks of these agreements for India’s export growth. (250 words)

- The inclusion of Indian bonds in global indices is expected to enhance foreign portfolio investment (FPI) inflows. Critically evaluate the impact of this move on India’s financial markets. (250 words)

- Discuss the role of remittances in stabilizing India’s current account balance. What measures can be taken to sustain remittance inflows in the future? (250 words)

4. Employment & Labor Market

- India has witnessed a rise in formal employment with increasing EPFO enrollments, yet job creation in the manufacturing sector remains weak. Analyze the reasons for this paradox and suggest solutions. (250 words)

- Artificial Intelligence (AI) and automation are transforming India’s labor market. Discuss the impact of AI-driven disruptions on employment and suggest strategies for workforce reskilling. (250 words)

5. Financial Sector & Banking Stability

- India’s banking sector has shown resilience with declining NPAs and strong credit growth. However, rising unsecured loans pose a new challenge. Discuss the risks associated with consumer credit expansion and suggest regulatory measures to manage them. (250 words)

- Financial inclusion is key to India’s economic development. Assess the impact of initiatives like Jan Dhan Yojana, digital payments, and fintech innovations on financial inclusion. (250 words)

6. Technology, Innovation & Green Economy

- India’s semiconductor mission is crucial for technological self-reliance. Examine the challenges in developing a domestic semiconductor industry and suggest policy measures to overcome them. (250 words)

- Renewable energy and electric mobility are central to India’s climate commitments. Discuss the progress made in these sectors and the challenges in achieving India’s 500 GW renewable energy target by 2030. (250 words)

- India’s AI and digital economy are growing rapidly. What steps should be taken to ensure that AI development is ethical, inclusive, and aligned with India’s socio-economic needs? (250 words)

7. Agriculture & Rural Development

- The use of AI, IoT, and precision farming is revolutionizing Indian agriculture. Analyze the potential of these technologies in improving agricultural productivity and reducing input costs. (250 words)

- India’s food security depends on sustainable agriculture and climate resilience. Discuss the role of organic farming, water conservation, and agroforestry in ensuring long-term agricultural sustainability. (250 words)

Essay Topics (Relevant for UPSC Mains Paper 1 – Essay Paper)

- India’s Economic Growth Amidst Global Uncertainties: Challenges & Opportunities

- Balancing Growth and Inflation: The Role of Monetary and Fiscal Policies in India

- Technology-Driven Development: The Future of AI, Semiconductors, and Digital India

- Infrastructure, Urbanization, and Smart Cities: The Path to Sustainable Development

- Financial Inclusion as a Catalyst for Economic Empowerment

Useful Links :

Indian Economy

- Millennium Development Goals (MDGs): A Comprehensive Analysis

- Multidimensional Poverty Index (MPI) – Economy Notes for UPSC 2025

- Sustainable Development Goals (SDGs): Relevance in UPSC Mains and Prelims

- India’s Energy Security: Challenges and Opportunities

- India’s Urbanization: Challenges and Opportunities

- Water Security in India: Challenges and Solutions

- Agricultural Challenges and Opportunities in India

- India’s Infrastructure Development: Challenges and Opportunities

- Digital Transformation in India: Challenges and Opportunities

- Sustainable Development Goals (SDGs): A Comprehensive Analysis 2025

- 2030 Agenda for Sustainable Development: A Comprehensive Analysis

Overall Summary of Economic Survey Chapter 1: State of the Economy

The Economic Survey Chapter 1 titled “State of the Economy: Getting Back into the Fast Lane” provides an in-depth analysis of India’s economic performance in FY25, set against a backdrop of global economic fluctuations, geopolitical risks, inflationary trends, and investment dynamics. The Economic Survey Chapter 1 assesses key macroeconomic indicators, including GDP growth, investment trends, inflation control, trade balance, fiscal stability, employment, and financial sector resilience.

1. India’s Economic Growth: Resilience Amidst Global Uncertainty

The Economic Survey Chapter 1 highlights India’s strong economic fundamentals, projecting a 6.4% real GDP growth in FY25, with a range of 6.3-6.8% expected in FY26. While global economic growth remains moderate, driven by differentiated regional recovery patterns, trade policy shifts, and geopolitical risks, India’s economic trajectory remains robust, supported by agriculture, services, and public investment.

🔹 Key Growth Drivers in Economic Survey Chapter 1:

- Agriculture and rural demand recovery due to record Kharif production.

- Stable private consumption and increased capital investment.

- Expansion of services sector, particularly financial, IT, and real estate.

- Fiscal discipline and strong external sector balance.

🔹 Challenges Identified in Economic Survey Chapter 1:

- Slowdown in global demand affecting India’s manufacturing sector.

- Inflation volatility, particularly in food prices, remains a key concern.

- Investment pickup in the private sector still uncertain.

2. Investment & Inflation Trends in Economic Survey Chapter 1

A. Public & Private Investment

The Economic Survey Chapter 1 highlights the government’s continued push for capital expenditure, with public capex growing by 8.2% in FY25, focused on infrastructure, roads, power, defense, and railways. However, private investment remains sluggish, though increased order books (up by 23.6%) indicate potential future growth.

🔹 Public Investment in Economic Survey Chapter 1:

- Major government spending on transport infrastructure, metro projects, and digital connectivity.

- Encouragement of private sector participation through PLI schemes and deregulation.

🔹 Private Investment Trends in Economic Survey Chapter 1:

- Global uncertainties, slow consumption recovery, and policy shifts affecting investor sentiment.

- Encouraging signs include higher corporate capacity utilization and fresh investment intentions.

B. Inflation: Moderating but Food Prices a Concern

Inflation remains a critical issue in Economic Survey Chapter 1, with headline CPI inflation at 4.9% (April-Dec 2024). While core inflation (excluding food and fuel) remains stable at 4.5%, food inflation remains high at 8.4%, driven by vegetables, pulses, and supply chain disruptions.

🔹 Economic Survey Chapter 1 highlights why inflation control is crucial:

✅ Stable core inflation benefits businesses and long-term economic planning.

❌ High food inflation erodes purchasing power, impacting household budgets.

✅ Government interventions in food supply and policy adjustments expected to ease inflation in H2 FY25.

3. External Sector & Foreign Exchange Reserves in Economic Survey Chapter 1

The Economic Survey Chapter 1 underscores India’s strong external sector performance, despite global trade disruptions and policy uncertainties. Merchandise exports grew by 1.6% (April-Dec 2024), while services exports continued to rise, making India the 7th largest services exporter globally.

🔹 Key Findings in Economic Survey Chapter 1:

- India’s foreign exchange reserves reached $634.6 billion (January 2025), covering 10 months of imports.

- Remittances hit a record high, making India the world’s largest recipient of remittances.

- Trade risks include Western protectionist policies and tightening global financial conditions.

❌ Concerns highlighted in Economic Survey Chapter 1:

- Potential disruptions in trade policies from Western economies affecting Indian exports.

- Higher global interest rates may slow down FDI and foreign portfolio inflows.

4. Employment & Labor Market Trends in Economic Survey Chapter 1

The Economic Survey Chapter 1 presents a positive employment outlook, with the unemployment rate dropping to 3.2% (2023-24) and an increase in formal employment as seen in EPFO enrollments (95.6 lakh in April-Nov 2024).

🔹 Key Labor Market Insights in Economic Survey Chapter 1:

- Formal employment rising due to EPFO enrollments, with 47% from the 18-25 age group.

- Manufacturing sector job growth remains weak, requiring targeted reforms.

- AI and automation impacting traditional employment structures.

✅ Government policies like Skill India, digital literacy programs, and MSME growth are expected to enhance job creation.

5. Financial Sector Stability in Economic Survey Chapter 1

The Economic Survey Chapter 1 outlines India’s stable banking and financial system, with declining NPAs, steady credit growth, and robust capital reserves. However, concerns over unsecured personal loans and rising household debt persist.

🔹 Banking Sector Highlights in Economic Survey Chapter 1:

- Gross NPAs declined to a 12-year low of 2.6%.

- Industrial credit growth remains moderate, but MSME and retail credit are expanding.

- RBI interventions to regulate unsecured loans and prevent excessive lending risks.

6. Future Roadmap & Economic Prospects in Economic Survey Chapter 1

The Economic Survey Chapter 1 sets the stage for India’s economic roadmap, emphasizing structural reforms, digital transformation, and global positioning to sustain high growth.

🔹 Opportunities Identified in Economic Survey Chapter 1:

✅ Boosting private investment through deregulation and corporate incentives.

✅ Developing future industries like AI, semiconductors, and green energy.

✅ Strengthening India’s role in global trade through FTAs and export diversification.

🔹 Challenges Highlighted in Economic Survey Chapter 1:

❌ Geopolitical tensions may disrupt trade and investment flows.

❌ Climate risks and agricultural vulnerabilities impact inflation and food security.

❌ Private sector investment still needs stronger momentum for sustained long-term growth.

🔹 Final Economic Outlook in Economic Survey Chapter 1:

- GDP growth projected at 6.3-6.8% in FY26, making India one of the fastest-growing economies.

- Inflation expected to stabilize, contingent on food supply improvements and policy interventions.

- Continued infrastructure expansion, digital economy growth, and trade partnerships to drive long-term development.

🚀 Conclusion: The Economic Survey Chapter 1 reaffirms India’s strong growth trajectory, highlighting both opportunities and challenges in navigating the evolving global economic landscape. With the right policies and strategic investments, India is well-positioned to sustain high economic growth and emerge as a global economic powerhouse. 🚀

Get Digital Current Affairs for UPSC and State PCS