February 27, 2026 3:33 pm

India’s Monetary and Financial Sector Developments: Cart and Horse

The Economic Survey Chapter -2 provides an in-depth assessment of India’s monetary and financial sector developments, outlining key trends, challenges, and the evolving policy landscape. As India continues to consolidate its position as a global economic powerhouse, the monetary and financial ecosystem is undergoing significant transformation. This article deciphers the survey’s key insights, delving into what has changed, how it impacts the economy, and India’s strategic approach to ensuring financial stability and growth.

1. The Bigger Picture: Financial and Monetary Landscape in India

Economic Survey Chapter -2 : What is the role of the financial sector in India’s economy?

The financial sector in any economy serves as the lifeblood of economic activity, enabling capital formation, credit availability, and wealth creation. In India, the banking sector, capital markets, non-banking financial institutions, insurance, and pensions collectively contribute to economic stability. The financial sector’s robustness determines how effectively India can tackle inflation, economic shocks, and financial inclusion challenges.

How has India’s financial sector performed in FY 2024-25?

- Credit growth is steady: The Indian banking system is witnessing steady credit expansion, converging towards deposit growth.

- Improved bank profitability: A decline in Gross Non-Performing Assets (GNPAs) and an increase in the Capital-to-Risk Weighted Assets Ratio (CRAR) indicate strong financial health of banks.

- Financial Inclusion is expanding: The Financial Inclusion Index (FII) by the Reserve Bank of India (RBI) surged from 53.9 in March 2021 to 64.2 by March 2024, reflecting India’s massive strides in banking accessibility, credit availability, and digital financial services.

Implications for India’s Growth Trajectory ( Economic Survey Chapter -2)

- A well-functioning financial sector encourages domestic savings, enabling funds to be directed toward productive investments.

- The rise of equity-based financing and IPO growth signals greater participation of young investors and increasing financial literacy.

- While digital banking and fintech innovations are making finance more accessible, they also introduce new regulatory and cybersecurity challenges.

2. India’s Monetary Policy: Balancing Inflation and Growth

What is monetary policy, and why is it important?

Monetary policy, formulated by the Reserve Bank of India (RBI), is a crucial instrument to regulate money supply, interest rates, and inflation. It aims to ensure price stability, promote economic growth, and maintain financial stability.

How did the RBI approach monetary policy in FY 2024-25?

- Policy Rate Unchanged: The Monetary Policy Committee (MPC) kept the repo rate steady at 6.5% throughout most of 2024 to control inflation while maintaining economic growth.

- Shift in Policy Stance: In August 2024, the RBI moved from a “withdrawal of accommodation” stance (focused on reducing excess liquidity) to a “neutral stance”, signaling confidence in managing inflation risks while allowing for growth.

- Liquidity Injection: In December 2024, the RBI reduced the Cash Reserve Ratio (CRR) from 4.5% to 4%, infusing ₹1.16 lakh crore into the banking system to stimulate credit growth.

Implications of India’s Monetary Strategy (Economic Survey Chapter -2)

- The policy continuity stabilizes market expectations, allowing businesses to plan investments with greater certainty.

- Inflation control remains a key priority, ensuring that household savings retain their purchasing power.

- A stable interest rate environment provides a growth cushion for sectors reliant on long-term financing, such as infrastructure and manufacturing.

3. Money Supply and Liquidity Trends: A Deep Dive

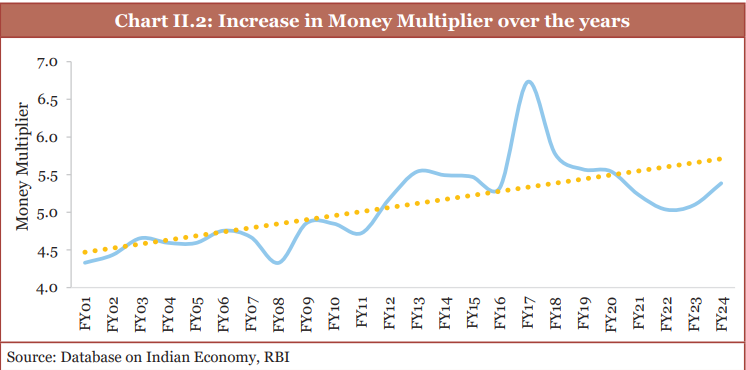

What are Money Supply (M0, M3) and the Money Multiplier (MM)?

- Reserve Money (M0) represents the most liquid form of money.

- Broad Money (M3) includes currency in circulation and bank deposits, impacting economic liquidity.

- The Money Multiplier (MM) determines how much credit banks can generate from central bank money.

How did liquidity trends evolve in FY 2024-25?

- M0 grew at 3.6% (YoY), down from 6.3% last year. This indicates a slower pace of money creation.

- M3 (adjusted for bank mergers) grew at 9.3%, showing steady credit expansion.

- MM increased to 5.7 (from 5.5 in 2023), reflecting higher banking system liquidity due to reduced cash hoarding and increased digital transactions.

Implications for India’s Economy

- A higher MM indicates efficient financial intermediation, ensuring that credit flows to businesses and households.

- Greater liquidity can fuel consumer spending, business expansion, and investments.

- However, too much liquidity may lead to inflationary pressures, requiring careful monetary management.

4. The Banking Sector: Strengthening the Core of India’s Financial System

What is the health of India’s banking sector?

- GNPAs declined to a 12-year low of 2.6% in September 2024. This improvement is due to better risk management, strong loan recoveries, and disciplined lending practices.

- Bank profitability surged, with Return on Assets (RoA) reaching 1.4% and Return on Equity (RoE) at 14.1%.

- Bank deposits grew by 11.1% (YoY) in November 2024, driven by higher interest rates on term deposits.

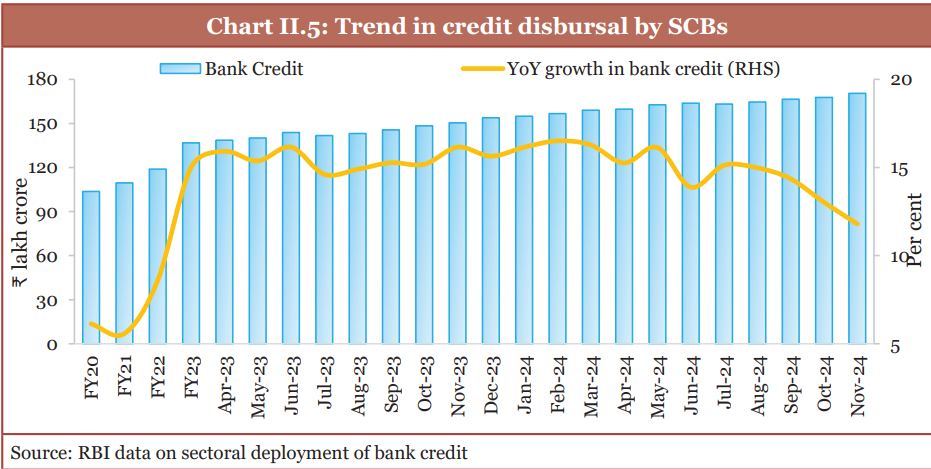

Key Credit Trends

- Non-food credit growth moderated to 7.5% (YoY), compared to 11% in 2023, reflecting higher borrowing costs and stricter credit regulations.

- MSME credit grew at 13%, outpacing lending to large enterprises, signaling strong small business expansion.

- Agriculture credit grew at 5.1%, while industrial credit improved to 4.4%, highlighting gradual recovery in rural and industrial financing.

Implications for India’s Growth

- A low GNPA ratio ensures financial stability, reducing risks for both lenders and borrowers.

- Credit expansion in MSMEs and agriculture is crucial for job creation and rural economic growth.

- Regulatory measures on unsecured lending ensure financial discipline, preventing reckless credit expansion.

5. Capital Markets: The Rise of Equity and Debt Financing

How have capital markets performed in FY 2024-25?

- Record IPO activity: The number of IPOs surged sixfold (FY13-FY24), with ₹1.53 lakh crore raised in 2024.

- Stock market highs: The NIFTY 50 returned 4.6% (April-December 2024), driven by strong earnings and increased investor participation.

- Corporate bond market expanded: Total issuances reached ₹7.3 lakh crore, signaling greater reliance on market-based financing.

Implications for India’s Economic Development

- Increased financialization of savings ensures higher domestic capital mobilization for businesses.

- Retail investor participation surged, with demat accounts growing to 18.5 crore in December 2024.

- Mutual funds gained traction, with assets under management (AUM) soaring to ₹66.9 lakh crore, demonstrating growing investor confidence.

6. The Role of Rural Financial Institutions (RFIs) in India’s Financial Inclusion Drive

What Are RFIs and Why Are They Important?

Rural Financial Institutions (RFIs) play a pivotal role in ensuring financial inclusion, particularly in underserved rural areas. These institutions provide credit accessibility, support agriculture financing, and empower rural entrepreneurs by offering tailored financial products. The Indian government has been actively promoting RFIs through regional rural banks (RRBs), rural cooperative banks (RCBs), small finance banks, NBFCs, and microfinance institutions.

How Have RFIs Performed in FY 2024-25?

- The number of RRBs declined from 133 in 2006 to 43 in 2023 due to mergers aimed at improving efficiency.

- RRB coverage expanded from 523 districts in 2006 to 696 districts in 2024, reflecting greater reach in rural India.

- Total deposits in RRBs increased significantly, with 31.3 crore deposit accounts and 3 crore loan accounts as of March 2024.

- The government infused ₹10,890 crore in recapitalization assistance to strengthen RRBs and improve governance.

- GNPAs in RRBs fell to a 10-year low of 6.1%, demonstrating better loan recovery and risk management.

Implications for India’s Rural Economy

- Stronger RFIs mean better access to credit for farmers, enabling higher agricultural productivity and rural employment.

- Lower GNPA ratios indicate better financial discipline, ensuring sustainable credit expansion.

- Government-backed recapitalization efforts are crucial to ensuring long-term viability of RFIs.

7. Development Financial Institutions (DFIs): Rebuilding India’s Infrastructure Finance

What Are DFIs and Why Do They Matter?

DFIs are specialized institutions that finance large-scale infrastructure projects crucial for economic growth. Unlike commercial banks, which focus on short-term lending, DFIs offer long-term project financing.

How Have DFIs Performed in FY 2024-25?

- The Infrastructure Finance Company (IIFCL) sanctioned ₹2.8 lakh crore for over 780 projects across highways, energy, and ports.

- NaBFID (National Bank for Financing Infrastructure and Development) sanctioned ₹1.3 lakh crore in infrastructure loans, with a strong focus on renewable energy and roads.

- IIFCL-financed projects contribute 22% of India’s national highway capacity and 23% of its installed power generation capacity.

Implications for India’s Infrastructure Growth

- DFIs provide critical financing for India’s infrastructure ambitions, supporting sustainable urbanization.

- Stable long-term financing solutions help mitigate risks in large-scale projects.

- Higher DFI participation ensures greater private sector confidence, attracting foreign investments.

8. Artificial Intelligence (AI) in Banking: A Game Changer for Financial Services

How Is AI Transforming the Indian Banking Sector?

AI and Machine Learning (ML) are reshaping banking by improving efficiency, risk management, fraud detection, and customer service. Globally, AI adoption in finance has led to better decision-making, cost reductions, and personalized banking experiences.

How Are Indian Banks Using AI?

- AI-driven credit underwriting helps assess borrower risk in real-time, reducing loan defaults.

- Fraud detection and prevention systems use AI to identify suspicious transactions, enhancing security.

- Regulatory capital planning and liquidity management are becoming more data-driven.

- AI-powered chatbots improve customer interactions, reducing wait times and improving banking accessibility.

Risks and Challenges

- The “Black-Box” problem: Many AI systems lack transparency, making it hard to explain decision-making processes.

- Cybersecurity risks: AI-driven fraud detection must evolve to counter new hacking and phishing attacks.

- Regulatory concerns: The RBI has launched a committee for Responsible and Ethical AI (FREE-AI) to address biases, fairness, and ethical AI governance.

Implications for India’s Financial System

- AI in banking will reduce inefficiencies, increase automation, and improve financial inclusion.

- India must ensure robust AI governance frameworks to avoid risks related to biases, fraud, and lack of accountability.

9. India’s Insolvency and Bankruptcy Code (IBC): Strengthening Debt Resolution Mechanisms

What Is IBC and Why Is It Important?

The Insolvency and Bankruptcy Code (IBC) was introduced in 2016 to create a streamlined, time-bound process for resolving distressed businesses. The IBC ensures that creditors recover dues while allowing businesses to restructure or exit efficiently.

How Effective Was the IBC in FY 2024-25?

- 1068 resolution plans were approved, with creditors recovering ₹3.6 lakh crore (161% of liquidation value).

- 79 companies were closed by sale as a going concern, preserving jobs and business value.

- 28,818 default cases worth ₹10.2 lakh crore were resolved before admission, showing a deterrent effect on willful defaulters.

Challenges and Solutions

- Delays in resolution: The average time for corporate insolvency resolution increased to 582 days, surpassing the original 330-day limit.

- Need for specialized tribunals: Strengthening National Company Law Tribunal (NCLT) capacity is crucial to reducing case backlogs.

- Greater digitalization can improve debt resolution efficiency, reducing legal hurdles.

Implications for India’s Credit Market

- The IBC strengthens India’s financial system, making credit markets more robust and predictable.

- Faster resolutions help businesses recover and ensure creditors receive fair compensation.

10. India’s Capital Markets: The Surge in Retail Investor Participation

How Have Capital Markets Evolved?

India’s stock markets are among the best-performing globally, supported by rising investor participation, strong corporate earnings, and proactive regulatory frameworks.

Key Trends in FY 2024-25

- Market Capitalization Growth: BSE market capitalization crossed $5 trillion for the first time in May 2024.

- IPO Boom: India led global IPO activity, accounting for 30% of total IPOs in 2024, up from 17% in 2023.

- Retail Investor Growth: The number of demat accounts surged to 18.5 crore, reflecting growing retail investor confidence.

- Mutual Fund Expansion: Assets under management (AUM) grew to ₹66.9 lakh crore, with SIP (Systematic Investment Plan) contributions exceeding ₹10.9 lakh crore.

Risks to Market Stability

- US stock market volatility could trigger capital outflows from India.

- Regulatory oversight on algorithmic trading and high-frequency trading is needed to prevent market manipulations.

- Retail investor protection measures must evolve as more young investors enter the markets.

Implications for India’s Financial Ecosystem

- A strong capital market boosts wealth creation, economic growth, and global investor confidence.

- Higher retail participation ensures greater financial inclusion, diversifying market risks.

11. Strengthening India’s Financial Regulations: The Role of RBI and SEBI in Maintaining Market Stability

Why Are Financial Regulations Crucial?

A well-regulated financial system ensures economic stability, investor confidence, and protection against systemic risks. In India, the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) are the primary regulators overseeing monetary policies, banking operations, stock market governance, and financial integrity.

How Have Regulatory Measures Strengthened India’s Financial System in 2024-25?

1. RBI’s Role in Monetary Stability and Credit Regulations

- Regulation of Consumer Credit Growth: The RBI increased capital requirements for unsecured personal loans, credit cards, and loans to NBFCs from 100% to 125%, preventing excessive lending risks.

- Foreign Currency Deposit Liberalization: The RBI raised the interest rate ceiling on Foreign Currency Non-Resident [FCNR(B)] deposits, encouraging foreign investments in India’s banking system.

- Cybersecurity in Banking: The RBI has prioritized cyber-risk mitigation, introducing new risk assessment protocols and stress-testing mechanisms for digital banking operations.

2. SEBI’s Initiatives for Capital Market Stability

- Enhanced IPO Regulations: SEBI introduced stricter disclosure norms to ensure investor protection and prevent market manipulation in IPOs.

- Algorithmic Trading Oversight: Algorithmic trading poses risks of market distortions, and SEBI is implementing new checks to prevent excessive volatility and ensure fair trading practices.

- Encouraging Retail Investors: SEBI’s initiatives have expanded mutual fund penetration, retail trading participation, and alternative investment platforms for small investors.

Implications for India’s Financial Future

- Stronger regulations lead to greater financial transparency and investor protection, reducing market volatility risks.

- Enhanced banking oversight ensures sustainable lending growth, preventing financial crises.

- Cybersecurity measures protect India’s growing digital finance ecosystem, strengthening global confidence in its financial markets.

12. The Future of Digital Finance and Fintech in India

How Has Digital Finance Transformed India’s Banking System?

The digital banking revolution has changed how Indians save, invest, and transact. India’s fintech industry, supported by Unified Payments Interface (UPI), digital lending platforms, and blockchain innovations, is reshaping financial accessibility.

Key Digital Finance Trends in FY 2024-25

- UPI Transactions Surpass $2 Trillion: India’s UPI system recorded a historic high, processing over 10 billion transactions per month.

- RBI’s Central Bank Digital Currency (CBDC) Pilot: India is experimenting with a digital rupee, which could reduce dependency on cash and improve financial transparency.

- Growth in Digital Lending: NBFCs and fintech startups expanded their market, offering instant credit through AI-driven underwriting models.

- Blockchain Integration in Banking: Indian banks are exploring blockchain-based trade financing solutions, enhancing cross-border transaction security.

Challenges and Risks in Digital Finance

- Data Privacy Concerns: With the rise in AI-driven finance, ensuring secure digital identity verification is critical.

- Fraud Prevention: Cybercriminals are exploiting digital banking, necessitating stronger regulatory monitoring.

- Need for Regulatory Clarity: Fintech startups face evolving compliance challenges, requiring a clear and adaptive regulatory framework.

Implications for India’s Financial Ecosystem

- Digital banking will expand financial inclusion, particularly in rural India.

- Secure and transparent fintech regulations will boost consumer trust and global investor interest.

- India’s leadership in digital payments can position it as a global fintech innovation hub.

13. The Evolution of Insurance and Pension Sectors in India

Why Are Insurance and Pension Sectors Vital?

A strong insurance and pension ecosystem provides financial security, promotes long-term savings, and strengthens economic resilience.

Key Growth Trends in FY 2024-25

- Rise in Insurance Penetration: The insurance sector expanded, with a 15% YoY increase in premium collections.

- Government Push for Universal Coverage: Schemes like PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) and PM-SYM (Pradhan Mantri Shram Yogi Maan-dhan) saw significant adoption.

- Growth in Pension Fund Assets: The National Pension System (NPS) and Atal Pension Yojana (APY) witnessed higher enrollment, strengthening retirement savings.

Challenges in the Insurance and Pension Industry

- Underinsurance Problem: India’s insurance penetration (4.2% of GDP) remains lower than global standards.

- Regulatory Hurdles: Expanding private participation and ensuring claim settlements require streamlined regulatory processes.

- Rising Health Insurance Demand: Post-COVID, demand for health insurance surged, requiring insurers to introduce more affordable products.

Implications for India’s Social Security System

- Higher insurance penetration improves financial resilience during economic crises or medical emergencies.

- Expanding pension coverage ensures long-term economic stability for aging populations.

- Simplified regulations can increase private sector investments in insurance, fostering innovation and accessibility.

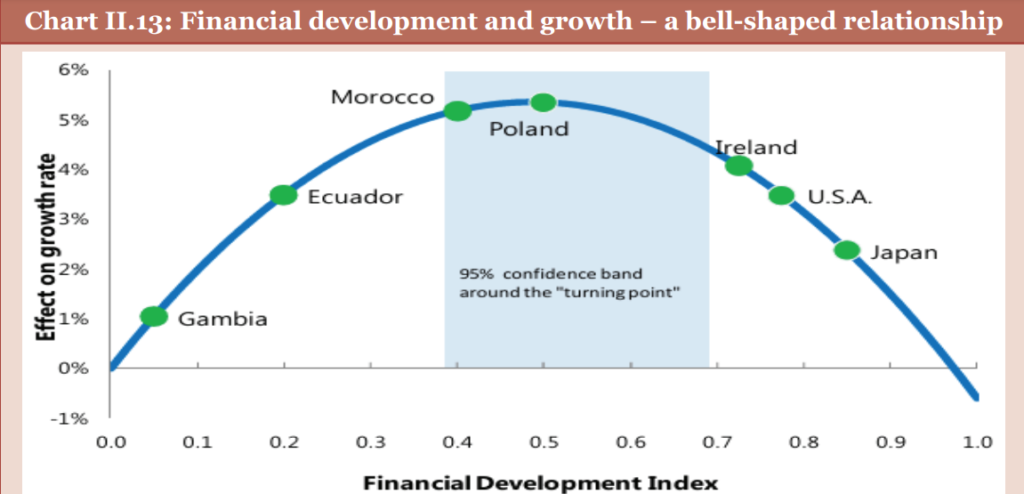

14. India’s Credit-to-GDP Ratio and Global Comparisons

Why Is the Credit-to-GDP Ratio Important?

The credit-to-GDP ratio measures credit availability relative to economic output. It reflects financial depth and economic expansion.

India’s Credit-to-GDP Ratio in 2024-25

- India’s bank credit-to-GDP ratio stood at 57.1%, lower than China (200.8%) and Malaysia (126.8%).

- Credit growth outpaced GDP growth for two consecutive years, signaling a healthy financial cycle.

- MSME credit expanded at 13%, showing strong small business financing support.

Global Comparisons and India’s Position

- Advanced Economies: The US, UK, and Japan have higher credit-to-GDP ratios (100%+), reflecting deeper financialization.

- Emerging Markets: India is ahead of Indonesia (33.4%) and Mexico (19.8%), but lags behind China and Malaysia.

Implications for India’s Financial Development

- A moderate credit-to-GDP ratio suggests room for further credit expansion, supporting business growth and investments.

- Maintaining healthy credit growth while preventing excessive lending risks will be key to sustainable financial development.

- Encouraging equity-based financing (IPOs, corporate bonds) alongside bank lending can balance financial risks.

15. India’s Economic Outlook: The Path Forward

Key Takeaways from India’s Monetary and Financial Developments

- Stable Monetary Policy: The RBI’s measured stance on interest rates and liquidity infusion ensured economic stability while preventing inflationary shocks.

- Banking Sector Strength: Declining GNPA ratios, rising credit disbursements, and improving financial inclusion reinforce India’s banking health.

- Capital Market Expansion: Surging IPOs, increased retail investor participation, and corporate bond market growth signal greater financial maturity.

- Digital and Fintech Innovation: India’s UPI dominance, AI-driven lending, and blockchain adoption will accelerate financial inclusion.

- Regulatory Oversight Is Evolving: Strengthening SEBI and RBI’s market supervision ensures fair trading practices, prevents financial risks, and builds investor trust.

Challenges Ahead

- Global Financial Uncertainty: US interest rate shifts, China’s economic slowdown, and geopolitical risks could affect capital flows into India.

- Rising Consumer Debt Risks: Increasing unsecured lending and digital lending expansion require stronger risk assessment mechanisms.

- Cybersecurity Concerns: As India’s financial system digitalizes, safeguarding against cyber fraud and data breaches is crucial.

India’s Strategy for 2025 and Beyond

- Deepen financial markets, making them more accessible, liquid, and inclusive.

- Encourage responsible AI adoption in banking to improve efficiency while mitigating risks.

- Expand global investment ties, ensuring stronger foreign capital inflows into infrastructure and financial markets.

Conclusion: India’s Financial Future – Stability, Growth, and Digital Transformation

Where Does India Stand?

India’s monetary and financial landscape is evolving rapidly, with strong banking fundamentals, growing capital markets, and increasing financial inclusion. However, emerging risks such as rising consumer debt, regulatory concerns, and global uncertainties require careful monitoring.

What’s Next for India’s Financial Sector?

- Strengthening AI governance in banking to ensure fair and ethical financial automation.

- Boosting capital market participation through investor education and regulatory reforms.

- Enhancing DFI funding to accelerate infrastructure development.

- Expanding rural financial inclusion through better digital access and stronger RFI networks.

With robust financial policies, innovation-driven banking, and sustainable credit expansion, India is well-positioned to achieve resilient economic growth while ensuring financial stability.

Final Verdict: A Resilient and Evolving Financial Landscape

India’s monetary and financial sector is on a strong growth trajectory, balancing stability, innovation, and regulatory prudence. With digital finance scaling new heights and capital markets booming, India is well-positioned to drive sustainable economic growth and global financial leadership in the coming years. 🚀

Why it is titled the cart and the horse?

The chapter “Monetary and Financial Sector Developments: The Cart and The Horse” in the Economic Survey 2024-25 uses the metaphor “The Cart and The Horse” to highlight the interdependent relationship between monetary policy and financial sector development in India.

What Does “The Cart and The Horse” Symbolize in This Context?

The phrase “putting the cart before the horse” is often used to describe a situation where priorities are misplaced. In the context of monetary and financial sector developments:

- The Horse represents monetary policy – which drives economic growth, financial stability, inflation control, and liquidity management.

- The Cart represents financial sector developments – including banking growth, capital market expansion, credit availability, and financial inclusion.

Why Is This Title Used?

- Interdependence Between Monetary Policy and Financial Sector Growth

- Monetary policy shapes the interest rate environment, liquidity conditions, and credit availability.

- A well-functioning financial sector ensures efficient capital allocation and economic expansion.

- Neither can function effectively in isolation; monetary policy must support financial sector growth, and financial sector developments must align with monetary stability.

- Balancing Growth and Stability

- The Indian government and RBI must ensure that monetary policies encourage financial sector expansion while maintaining economic stability.

- For instance, too much liquidity (monetary expansion) could lead to inflation, while excessive financialization (rapid credit growth) without strong monetary control could lead to asset bubbles or financial crises.

- Regulatory Challenges in Managing Both Forces

- The rise in consumer credit, digital finance, and IPO growth is exciting for financial sector expansion, but it also introduces risks such as increased household debt and stock market volatility.

- The RBI and SEBI must regulate financial innovation without stifling growth – keeping the cart (financial sector) moving, but making sure the horse (monetary policy) leads effectively.

Implications of the Title for India’s Economic Strategy

- A well-calibrated monetary policy must lead financial sector reforms, ensuring financial inclusion, credit growth, and market stability.

- The financial sector should not outpace monetary stability, as excessive lending, speculative market growth, and over-financialization could lead to economic risks.

- A balance between regulation and innovation will be key to ensuring sustainable economic growth while preventing financial imbalances.

Final Thought: Aligning the Horse and the Cart for India’s Economic Growth

India’s financial sector transformation requires thoughtful monetary policy leadership (the horse) to guide financial sector growth (the cart). By ensuring that monetary stability and financial development move in sync, India can create a resilient, inclusive, and dynamic financial ecosystem for long-term economic progress.

Useful Links

- Millennium Development Goals (MDGs): A Comprehensive Analysis

- Multidimensional Poverty Index (MPI) – Economy Notes for UPSC 2025

- Sustainable Development Goals (SDGs): Relevance in UPSC Mains and Prelims

- India’s Energy Security: Challenges and Opportunities

- India’s Urbanization: Challenges and Opportunities

- Water Security in India: Challenges and Solutions

- Agricultural Challenges and Opportunities in India

- India’s Infrastructure Development: Challenges and Opportunities

- Digital Transformation in India: Challenges and Opportunities

- Sustainable Development Goals (SDGs): A Comprehensive Analysis 2025

- 2030 Agenda for Sustainable Development: A Comprehensive Analysis

FAQs on Economic Survey

What is the Economic Survey?

The Economic Survey is an annual document published by the Ministry of Finance, Government of India, usually a day before the Union Budget. It provides a comprehensive analysis of India’s economic performance in the past financial year and outlines policy recommendations for the future.

Who prepares the Economic Survey?

The Economic Survey is prepared by the Department of Economic Affairs (DEA) under the Ministry of Finance, with inputs from various government departments. It is usually authored by the Chief Economic Adviser (CEA) of India.

What is the purpose of the Economic Survey?

The Economic Survey serves multiple purposes:

Informing investors, policymakers, and citizens about India’s economic outlook.

Analyzing macroeconomic trends in GDP growth, inflation, investment, trade, and employment.

Providing policy recommendations for future economic planning.

Assessing fiscal health and budgetary performance of the government.

Is the Economic Survey legally binding?

No, the Economic Survey is not legally binding. It serves as an advisory document for policymakers and offers recommendations but does not dictate government decisions.

When is the Economic Survey released?

The Economic Survey is typically released a day before the Union Budget in January or February.

What are the key themes covered in the Economic Survey?

The Economic Survey covers:

- Macroeconomic Overview – GDP growth, inflation, trade, fiscal health.

- Sectoral Performance – Agriculture, industry, services, infrastructure.

- Investment & Public Finance – Government expenditure, tax revenue, fiscal deficit.

- Employment & Labor Market Trends.

- External Sector Analysis – Trade balance, foreign exchange reserves, remittances.

- Structural Reforms & Future Outlook.

How is the Economic Survey structured?

The Economic Survey is divided into two volumes:

- Volume 1: Analytical and forward-looking, focusing on policy recommendations and economic theory.

- Volume 2: Data-driven, presenting statistical trends and factual analysis of India’s economic performance.

Why is the Economic Survey important?

The Economic Survey is significant because:

- It provides credible, research-backed insights into India’s economy.

- It helps the government frame policies for sustainable growth.

- It guides investors, researchers, and academicians with economic data.

- It acts as a basis for budgetary decisions and long-term economic planning.

How does the Economic Survey impact the Union Budget?

The Economic Survey provides key insights and recommendations that help shape the government’s budgetary policies. It influences:

- Fiscal deficit targets and taxation policies.

- Infrastructure investment plans.

- Social welfare schemes and economic reforms.

How is the Economic Survey different from the Union Budget?

Difference Between Govt. Budget and Economic Survey

| Feature | Economic Survey | Union Budget |

|---|---|---|

| Purpose | Analyzes past economic performance and gives future policy recommendations | Allocates financial resources for government spending and revenue collection |

| Legal Status | Advisory in nature | Legally binding |

| Prepared by | Ministry of Finance (Chief Economic Adviser’s office) | Ministry of Finance (Finance Minister’s office) |

| Release Date | A day before the Union Budget | February 1st each year |

| Scope | Analytical and theoretical | Practical and financial |

Who uses the Economic Survey?

The Economic Survey is used by:

- Government policymakers for economic planning.

- Economists and researchers for macroeconomic analysis.

- Investors and businesses for financial decision-making.

- Students and UPSC aspirants preparing for competitive exams.

What are some key highlights of past Economic Surveys?

Some key highlights of past Economic Surveys:

- 2023-24 Economic Survey: Focused on post-pandemic recovery, fiscal consolidation, and investment-led growth.

- 2022-23 Economic Survey: Highlighted Atmanirbhar Bharat, Make in India, and digital economy growth.

- 2019-20 Economic Survey: Introduced Thalinomics (affordability of food in India) and wealth creation models.

How can I access the full Economic Survey?

The Economic Survey can be accessed on:

- Ministry of Finance website: www.indiabudget.gov.in

- Press Information Bureau (PIB) releases.

- Government publications and reports.

Is the Economic Survey useful for UPSC preparation?

Yes! The Economic Survey is highly relevant for UPSC aspirants, especially for:

- General Studies Paper 3 (Economy, Infrastructure, Growth & Development).

- Essay Paper (topics on economic policies and trends).

- Interview Preparation, as it provides recent economic developments and policy recommendations.